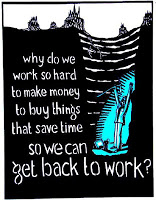

Have you ever wondered about the meaning of the phrase “Time Is Money”. Let me give you my spin on the term.

Everyday, most of use use money to purchase goods and services from other. Things that we can’t or don’t make ourselves, like food, shelter, clothing, and entertainment. In their basic form these things represent someone else’s time to which they have assigned a value to, or cost, in your local currency. We consume other’s produce.

Here is a better explaination. When you purchase an item of an agreed value, you use a form of time to buy it. You are using money, which was exchanged for your time by giving to someone else i.e. working for an employer. The work could be a job, it could even be produce that you made during your time, or a service you provide others during which you sacrifice your time. Money is time.

Now lets take it one step further. You go shopping and you see a shiny new iPad that you believe you just may need. The top of the line model costs about A$899, which is quite expensive for an electronic consumer item. Lets say you get paid $20 and hour (after income tax). It would take you 45 hours of full time work, just to pay for that one item. That is just over a week of your time. This calculation is not taking into consideration that you have to also work to put food in your family’s belly and a roof over your head! It is also assuming that you have been patient, have saved your money (aka time) and paid with cash savings.

So what happens when you buy the item on credit (loan)? Well you get the item instantly without sacrificing your time as yet, however you then enter into a legal and binding contract with your credit provider for your future time. You also have the added burden of paying back extra time in the form of interest payments, usually at a high rate depending on your ability to pay or have asserts that they could recover if you default on the loan. Sounds a bit like a type of slavery to me.

Let me mention one last example, albeit a small cost, but equally damaging over the longer term. In my recent Co-op post, I wrote about frugal food and how I take my home made lunch to work at least four days a week. If I bought my lunch at work at one of the expensive cafes around my building (between A$10-15), it essentially means that I would be spending the first hour of my working day slogging out just to earn the money to buy my lunch for the day. That doesn’t sound right, now does it?

Buy making your own lunch or forgoing that shiny new consumer electronic, not only are you saving money, you are saving your own time as well. What would happen if you diverted all of that spare money to your long term debts like your mortgage for instance? You get your time back because you don’t have to pay as much interest, that’s what would happen. Would you rather retire from full time work at 53 or at 65 or maybe never? I know which one I am choosing, because I would rather be young and grey, than work for the rest of my time.

I have so much more to offer, and I want to keep my time to myself!

Agreed, my time is so much more valuable. I just walked from a job with ‘resonsibility’ and gave up £10K per annum, I now have less money but twice as much time, which saves me a lot more than the money I ‘lost’ – I intend to retire at 60 and it’s worth saving for so I can have more time.

I can relate totally to your post. It works both ways. Time is money. Money is time. Why waste either, but in the long run, time is more precious.

Excellent post Gav, right up my ally. We think we live in a time of great wealth and abundace but this couldn’t be further from the truth. We might have lot of money and possessions (And yes most of us in the first world are financially well off! Compared to previous generations, we all can afford cars, tvs, mobile phone etc.) but today we live in the most poorest time ever, most of us are TIME poor. Give me time over money any day.